Trust DVAC to

Recover the True Value of Your Vehicle.

Statute of Limitations to File:

File First Party Claim:

File Third Party Claim:

Diminished Value Through Uninsured Motorist Coverage:

Small Claims Max Filling:

OUR PROVEN PROCESS

Start the process with a FREE consultation when you call us at (877) 879-0101 or fill out our Appraisal Form and we will contact you within minutes!

We analyze data to determine your vehicle’s true diminished value and deliver a quick, accurate appraisal that insurance companies can’t ignore.

We don’t stop at a report. We advise and support you through negotiations every step of the way until you receive your rightful compensation.

Experiencing a vehicle accident is a distressing event that can leave lasting effects. It’s crucial to handle the aftermath with composure and a clear plan of action to safeguard yourself and others involved. Whether it’s a minor bump or a major collision, understanding the steps to take can significantly impact your recovery process. In addition […]

Read More

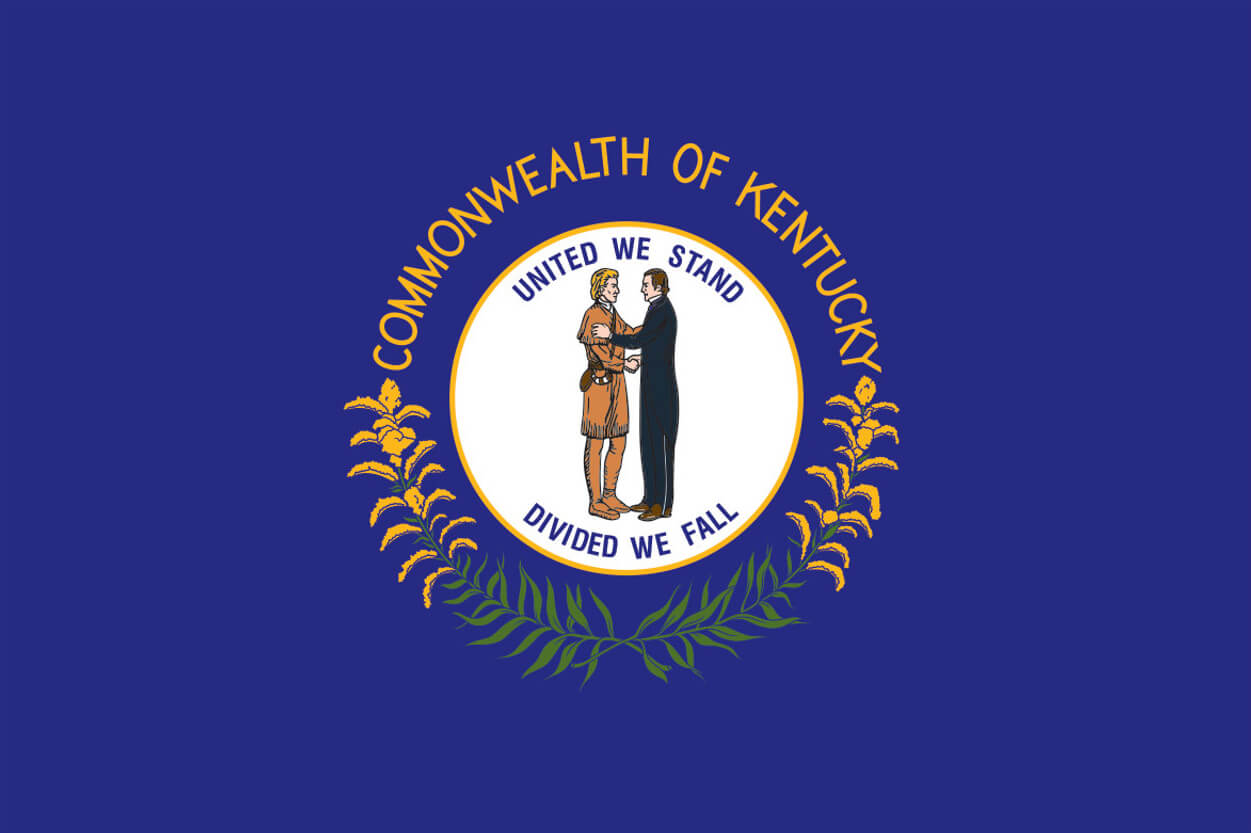

Diminished value of your vehicle is recoverable in third-party cases only. You can only recover from third-party at fault insurance companies and you cannot make a claim under your own uninsured motorist insurance. All drivers must carry minimum liability insurance, and the statute of limitations is 2 years from the time of the accident. HB 206 (BR 943).

Muncie v. Wiesemann, 2018 K.Y. LEXIS 257, Supreme Court of Kentucky:

The court held that stigma damages are recoverable in addition to repair costs, but the total of the stigma damages and repair costs cannot exceed the diminution in the fair market value of the property. The court’s decision establishes that if the repair costs are insufficient to make the plaintiff whole, a recovery for stigma damages up to the amount of the diminution in the market value of the home is appropriate.

Stigma damages compensate for loss to the property’s market value resulting from the long-term negative perception of the property in excess of any recovery obtained for the temporary injury itself. Were this residual loss due to stigma not compensated, the plaintiff’s property would be permanently deprived of significant value without compensation. We concur with that definition of stigma damages.

Even after repairs, your car may lose resale value due to its accident history—known as diminished value. Many buyers avoid damaged vehicles or expect a discount, but you have the right to file a diminished value claim. Some insurance companies won’t inform you of your right to an independent appraisal and often minimize payouts. With accurate data and a strong claim, DVAC ensures you get the compensation you deserve.

Call DVAC at 877-879-0101 for a FREE consultation or Start your Appraisal now!