Boat Appraisals

Our experts offer a fair market analysis to ensure you know your boat’s true worth.

Need a Certified Appraisal for Your Boat?

When negotiating a settlement with your insurance company, having your own certified, independent appraisal is crucial. Many insurers rely on automated systems that fail to consider important details about your boat. At DVAC, we provide accurate, fair market appraisals for all makes and models, ensuring your vehicle’s true worth is recognized. Protect your investment and gain peace of mind with a trusted, professional appraisal.

Get A Diminished Value or Total Loss Appraisal for Your Boat

Your Personal Consultation will address:

- A comprehensive review of repair costs and estimates.

- An objective determination of whether your vehicle qualifies for diminished value or qualifies for a total loss settlement.

- An approximate range of compensation you may be paid for your loss.

Navigating Boat Diminished Value Settlements after Damage

Whether cruising through tranquil waters or enjoying a day of fishing with friends, owning a boat can bring endless joy and adventure. However, accidents happen and when your beloved vessel sustains damage, navigating the process of seeking compensation can be daunting. One avenue, often overlooked, is diminished value settlements. Let’s explore what a boat diminished value settlement entail sand how to know if you’re eligible to pursue one. Understanding Boat Diminished Value Settlements Diminished value refers to the reduction

Navigating Boat Diminished Value Settlements after Damage

Whether cruising through tranquil waters or enjoying a day of fishing with friends, owning a boat can bring endless joy and adventure. However, accidents happen and when your beloved vessel sustains damage, navigating the process of seeking compensation can be

Real Reviews, Real Results

Frequently Asked Questions

When Should I File a Diminished Value Claim?

You should pursue a diminished value claim once your vehicle is fully repaired to pre-accident condition. Experts calculate diminished value based on the nature of the damage to your vehicle and overall evidence of repairs. A thorough review of the final bill from the bodyshop, a visual inspection of the vehicle after repairs, and a review of the Carfax are a few important factors in determining diminished value.

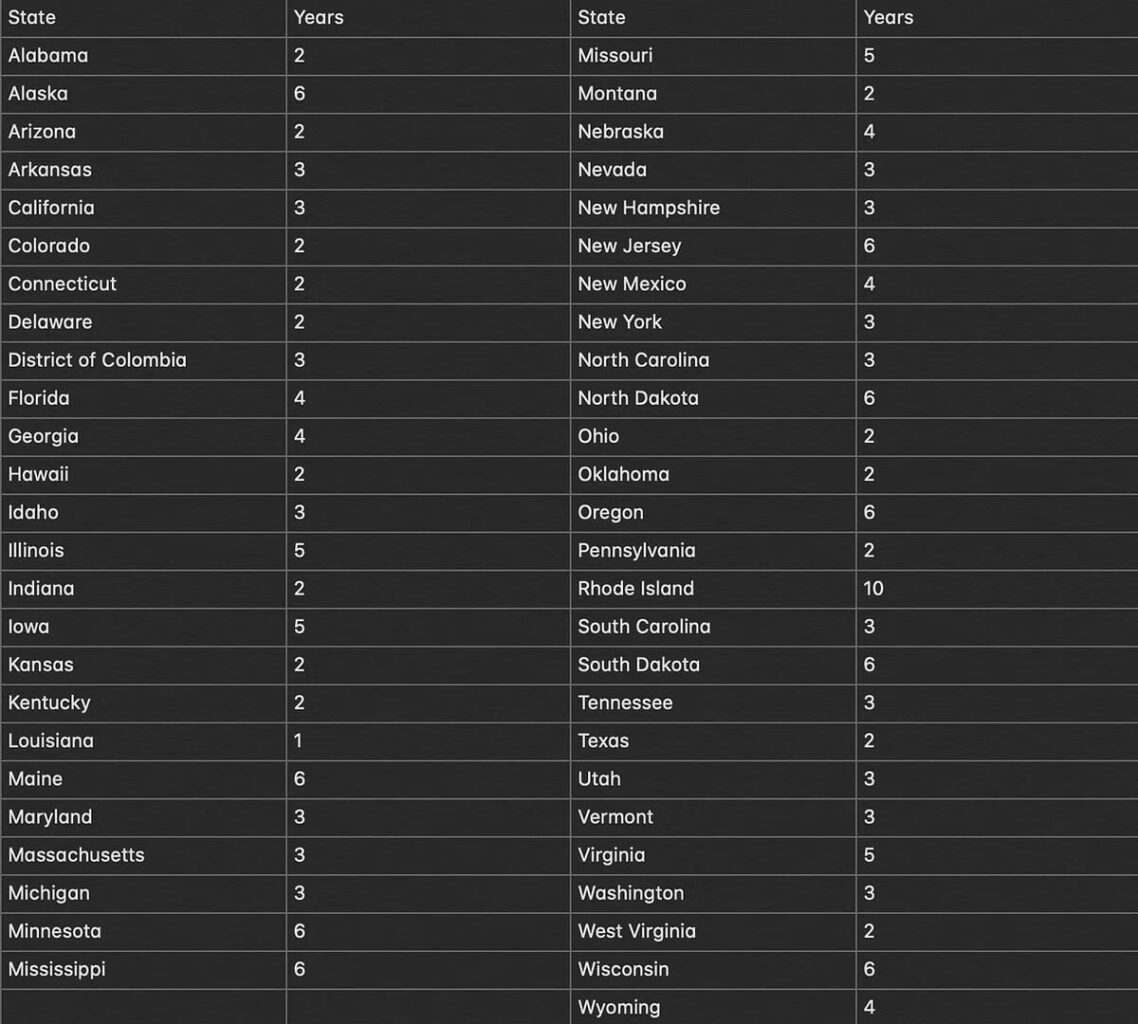

How Long Can I Wait To File a Diminished Value Claim? In Years..

How Long Does The Process of Recovering My Settlement Take?

Recovering diminished value from the at-fault insurance company can take as little as a few days. However, some claims may take weeks—and in rare cases, months. The timeline depends entirely on the insurance company’s diminished value policy. One thing remains constant: DVAC will stay involved throughout your DOV claim, offering advice and support.

What is a Total Loss Report?

If your vehicle has been totaled in an accident, how do you determine a fair settlement? The insurance company has their figure, and you have yours. DVAC helps bridge that gap by guiding you to a realistic, mutually agreeable number backed by comprehensive market research. We compile a total loss report that includes all of our findings and your vehicle’s actual cash value.

What's Included In My Report?

We equip each diminished value appraisal report with a vAuto market analysis, NADA Archival Valuation, and a complimentary Carfax. vAuto captures 100% of all U.S. sales data for any vehicle. Using this powerful tool, we compile an extremely accurate pre-accident value and assess diminished value based on the nature of your vehicle’s repair records. We also include a detailed photo file and the final bill from the body shop. Once everything is compiled, we email you a comprehensive 20–30 page diminished value appraisal report.

Been In An Auto Accident?

If an accident has damaged your vehicle and you’re concerned about its true value, call DVAC Diminished Value Appraisal Claims at 877-879-0101 for a FREE consultation. If you’re ready to start the process, start your appraisal now! You can also check out our blog for more case-specific information.

Start The Appraisal Process Now

Find out if you’re eligible for compensation with a quick and easy assessment.

No obligation required.

A+ Rating on BBB | Servicing Clients Nationwide